Budgeting Tools

It’s worth repeating: making a budget and utilizing appropriate budget tools isn’t just about how much money we have – it’s about making the most of what we’re given or what we earn. It’s about taking responsibility and having a plan – one we make and adjust as necessary, but a plan nevertheless.

There are endless benefits to utilizing the budgeting tools available to us and sticking to our budgetary commitments. Here are just a few:

Money problems are one of the greatest sources of stress and unhappiness in modern times. It can create physical as well as mental or emotional difficulty, and studies suggest difficulties stemming from money issues can be major factors in harming or destroying our most important relationships. It’s not always a question of how much we have, but of what we’re doing with it and how we feel about it. If you live with a significant other, you may find the first time you sit down to budget together to be a little emotionally loaded. Nothing brings our issues to the surface like money talk! But acknowledging this going in is half the battle. You might even decide to set a few basic “ground rules” before you begin. Once past the initial discomfort, however, you may find there’s serious mojo in setting and working towards financial goals together. Even something as simple as using the same household budget calculator can get you talking about priorities, and hopes, and wants, and needs. Take what may look like a negative and make it a positive. It can work, we promise you.

This is often, but not always, related to stress. People who effectively manage their money have better physical health and increased mental and emotional well-being. On a more basic level, we all know that access to health care is a major issue in modern America. Setting aside ongoing political debates and related social issues, your ability to get decent medical care for yourself and your loved ones can be a game-changer. Sure, it’s nice if you’re rich or have amazing insurance coverage. Even if you don’t, however, responsible money management dramatically increases your odds when it comes to getting into the right doctor at the right time.

If you’re always struggling financially, it’s difficult to achieve real stability. It can mean uncertainty about where your next meal will be coming from, how you’ll get the kids to soccer practice or violin lessons, or even where you’ll be living next month. It can make you afraid to answer the phone or even check your emails. Poor credit can even make it harder to get a job or lease an apartment. There’s a strong correlation between transient living (people who move far more than average) and poor money management. That means your kids are constantly changing schools (or not going) and sometimes means you have to keep changing jobs due to your limited transportation options. Either makes it almost impossible to get ahead or ever feel “grounded” where you are. We can debate whether or not this is fair or right, but either way, this is real life. These may be extreme examples, but more subtle variations occur every time we allow financial chaos to chip away at our well-being. A personal budget planner or some easy-to-use budgeting tools may not magically fix everything, but they can be an essential part of your foundation for turning things around.

Your credit score and credit history are not overly concerned with how much you make or how much you have, but with how well you manage your debts and how consistently you pay your bills, big or small. It may not seem urgent at the moment, but your credit score and credit history play a pretty big role in shaping your options over the course of a normal life.

If you ever choose to finance a vehicle, a few dozen points one way or the other in your credit score can mean a difference of thousands of dollars over the 3 – 5 years it takes you to pay it off. That’s money you could be using for other things during that same time period. If you take out a mortgage on a home for your family, your credit score is even more important. A difference of even half-a-percentage point in your interest rate can mean tens of thousands of dollars either way. Credit histories and those three-digit scores aren’t just for bragging rights – they impact your options and how much you’ll pay for almost everything the rest of your life. More than that, your credit score can create or eliminate some options altogether.

To be clear – using a budget calculator or setting up an online budget doesn’t automatically fix everything. What it does is place an anchor, a landmark, on the calendar of the rest of your life. It says, “Here is where it begins. Here is where we start moving forward instead of simply trying not to fall backwards.”

Finally, building a budget and sticking to it with some form of budget tracker utilizing online budgeting tools is the grown-up, responsible, ethical thing to do. It’s one of the things we used to assume all parents should teach their kids. Many states have even added some form of “financial literacy” to their required high school curriculums, not to produce CPAs or promote effective stock market investments, but to make sure the average citizen knows how to balance their checkbook and why credit cards can be dangerous and how to compare prices between the 12 oz size and the 18 oz size. Not having an effective budget tracker or some other form of budget spreadsheet doesn’t make you a bad person, but it does mean you have some room to grow up and improve a bit. That’s good – we all do.

You’ve probably seen those little “fitness trackers” that are so popular these days. They don’t tell you what to do or how to live, but they remind you of things you’ve decided you want to do anyway – get up and move for a bit, pay attention to your calories, don’t forget to build in some time for stretches or aerobics. A money budget app does the same thing for your wallet or pocketbook. It’s not there to tell you what to do or how to spend your money; it reminds you of the priorities you’ve chosen and makes it easier to achieve them.

No two budgets will look the same or work exactly alike – nor should they. There are, however, some general principles and procedures which seem to do the trick for most people. You may have seen the sorts of pen-and-paper ledgers used for budgeting and accounting back in the day. Ebenezer Scrooge had one, and they’re favorite primary sources in any Early American History class. They had their time and served their purpose, but they’ve largely been replaced by a drastic improvement – the computerized spreadsheet.

Your most basic laptop or desktop spreadsheet can organize and re-organize your columns, copy pages, do basic computations, and even create visual representations of your data for you with a click or two. They certainly still have their place. In the same way that your standard computerized spreadsheet dramatically changed the ease and flexibility of managing financial information, however, the right daily budget app or any number of online budgeting tools can take things a step or three further.

You’re here, so you must care about your financial health at least a little. That’s good! Before we get too deep into the specifics of creating a budget, however, let’s step back and recognize that a personal budget planner or various budgeting tools aren’t just about money. They’re about more efficient and more effective uses of our resources – not simply making more, but making the most of what we already have and continue to make.

Making a budget doesn’t say “I’m too concerned with money.” Living by your own carefully crafted budget and following your own stated priorities in that budget says, “I care about the people for whom I’m responsible.” It says, “I want to be able to take care of myself and my basic needs as the years go by.” It says, “I have a responsibility to be a good steward of what’s available to me.” You don’t celebrate Christmas because you’re obsessed with dead trees, and you don’t bake your bestie a birthday cake because you’re heartless about the dangers of diabetes. An effective budget is as much an act of adulting and caring for yourself and others as anything.

Yes, money matters. It’s a reality of the world in which we live. As Winston Churchill might have put it, capitalism is the worst type of economy there is, except for all the other economic systems which have been tried. But most of us aren’t looking to get rich no matter what we have to do to get there. It sure wouldn’t hurt to have a better idea what our retirement could look like, however. It would be nice to be able to pay for that wedding we know is coming someday. And we wouldn’t complain if we had the ability to provide for our own healthcare or at least somehow paid off our home and credit cards before we one day shed this mortal coil.

Imagine the ability to create a budget online using existing templates or modifying them as much as you wished to personalize any budget list to be as useful as possible for you and your specific circumstances.

Imagine easily categorizing your income and spending with a few clicks or swipes for easy retrieval or reporting in whatever format you find most useful. Imagine an app that’s more than a budget calculator, it’s a budget organizer and analyzer as well.

Imagine alerts and updates whenever your activity strays too far from your stated priorities. Imagine easily setting up automatic reminders for the things that matter most to you – bills coming due, automatic debits being processed, or related budgeting tools which would effectively cooperate with the budget planner app or online budget spreadsheet you already use.

Imagine debt reduction strategies presented in real time and as easy to follow as keeping your fitness tracker happy.

Imagine immediate access to our curated library of budgeting tips and the latest budgeting tools to browse or save on any connected device. Informational articles on managing debt, reducing monthly bills, or smart investments on a limited budget – all at your fingertips for those moments you have a few minutes in the waiting room, having lunch, or unwinding after the kids are asleep.

Imagine how easy it is to save money on bills by having your finances and billing at your fingertips or a few clicks away on any connected device. Imagine how much more efficiently you can reduce your debt when the same technology that tries to get you to buy stuff or lose yourself on social media is dedicated to helping you make more strategic financial choices.

It’s unified finance. Let’s put the “personal” back onto personal budgets.

If you found us because you need some ideas or help setting and sticking to personal budget goals, or you need a budget tracker, or you just want some fresh budget tips, that’s awesome – we’re glad you’re here. There’s plenty here for you to access right now, free of any sort of charge or obligation, and more coming soon. We’re glad you found your way to us, and we’d like to do whatever we can to help while you’re here.

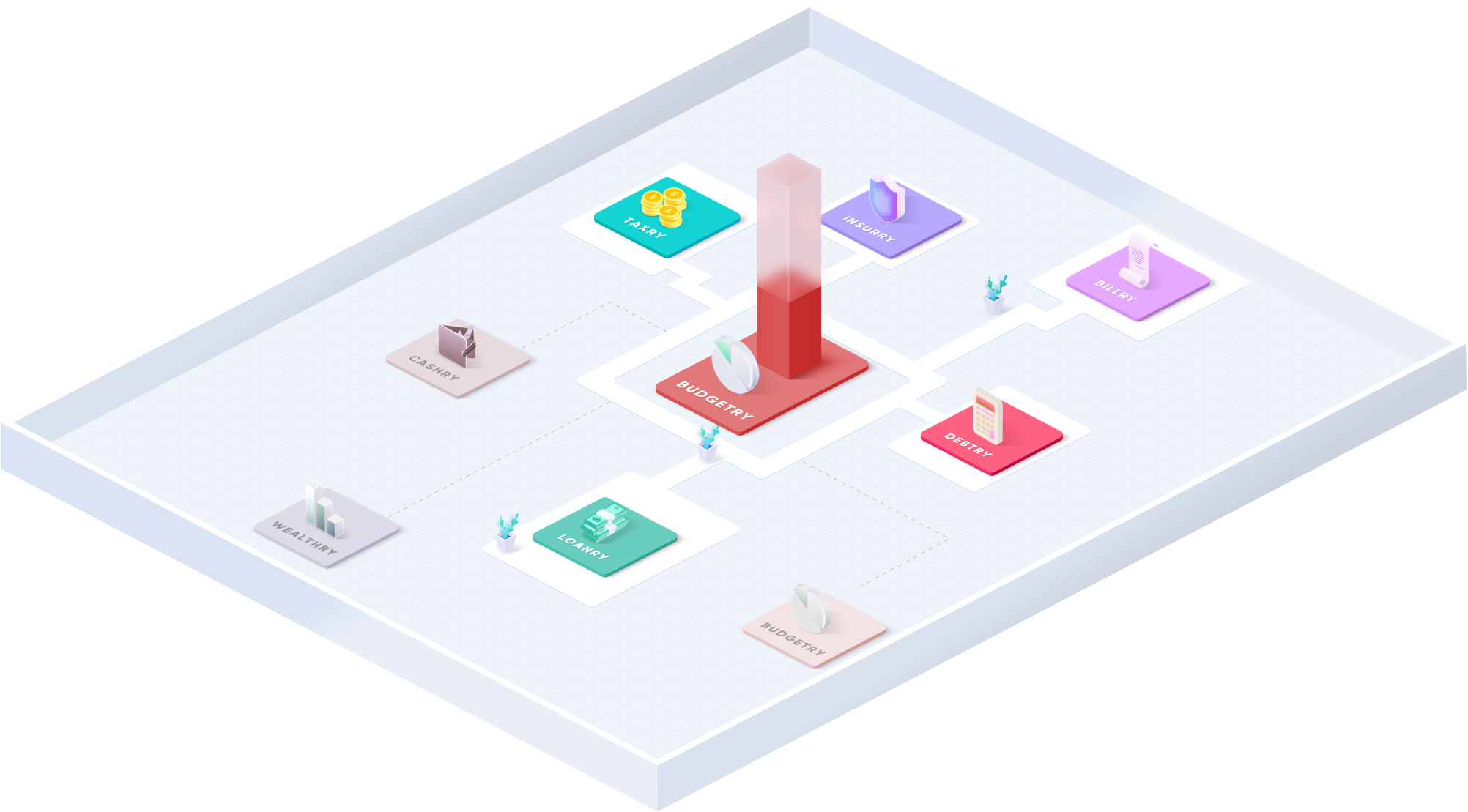

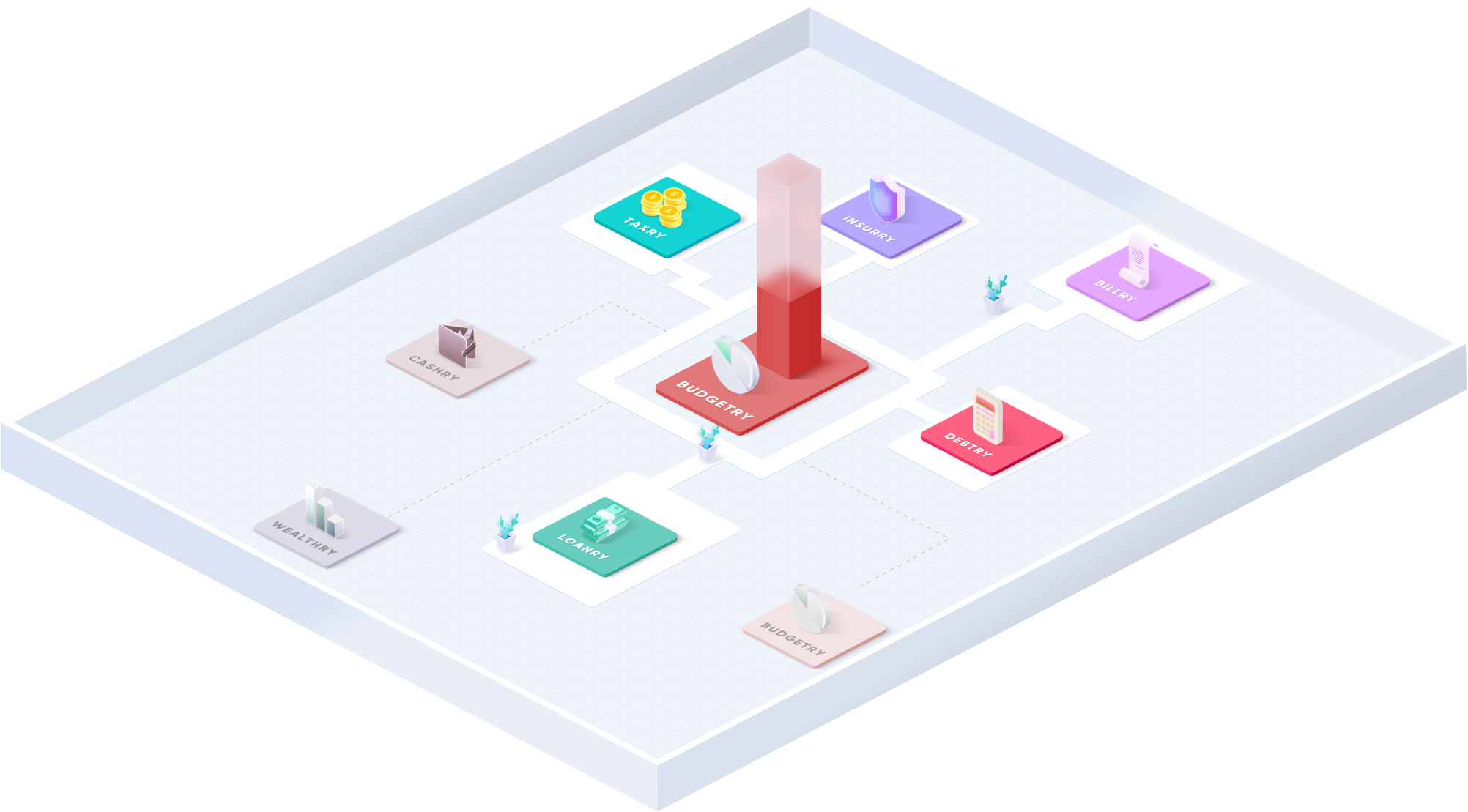

Please know, however, that taking advantage of the tools and information offered here at Budgetry gives you the same access to our sister sites and anything they have to offer as well. Information and options for checking your credit report, determining the real value of your real estate, understanding the ins and outs of refinancing a mortgage or financing a vehicle – it’s your call how much you use and when. If you want more options for refinancing your home, vehicle, or even your student debt, we can connect you to some surprisingly competitive options for that. If you need to better understand different sorts of small business loans, well… we’re pretty good at that as well.

It's whatever you need, whenever you need it – as much or as little as you like. Always transparent, always real, always in plain, simple English. That’s the whole idea of an online financial content mall, after all.

Feel free to look around, and let us know if we can help.

Our philosophy and Budgetry, and across the Goalry family, is simple. We believe that with the right information, access, connections, and tools, most of us are perfectly capable of taking more effective control of our personal or small business finances. Whether it’s building a budget, taking out a personal loan, or investing in the future, we believe in the power of unified finance to make personal and small business finances more understandable and more efficient.