Well, literally it does – but not as an idiom or idea. Debt is a powerful tool that allows Americans with average incomes to buy homes for their families, drive decent vehicles, get educations after high school, and otherwise live flexibly and far more freely than would otherwise be possible.

Debt can make a wonderfully effective servant, but far too easily becomes a cruel master. We sometimes talk about a “debt avalanche” because (a) everything seems fine until suddenly it very much doesn’t, (b) it snowballs rapidly once moving, and (c) if you’re not careful, you’ll end up feeling buried and trapped.

It’s a no-brainer, right? The easiest way to pay off debt is to make way more money and then we can afford everything we need and never have to worry again. Problem solved – well, except for the “making way more money” part.

Or is it? Sure, if you were born into so much wealth that you can’t lose it fast enough to offset your eternal dividends, you’re probably not reading this site right now wondering how to pay bills and debts effectively or adopt a long-range debt management plan. For the rest of us, however, it’s usually not that simple.

Experience suggests that if you manage to save 10% of your income when you have very little, you’ll keep saving when you have lots of money. If you’re spending more than you make when you’re in a low tax bracket, you’re likely to spend in roughly the same percentages when you’re in a high tax bracket.

Yes, a budget to pay off debt is more challenging when you’re struggling to make ends meet each month. But unless we change our underlying habits in regards to our personal finances and change our mindset about debt and debt management, making a little more money isn’t going to fix anything – at least not long-term.

Real change starts with a decent household or small business budget.

While it’s true things are far from ideal, we nevertheless live in miraculous times. Technology offers connections, conveniences, and entertainment beyond what we could have imagined even a generation ago. There’s simply no excuse not to put that technology to work for you, whether it’s helping you pay bills and debts more efficiently or prioritizing debt reduction and budgeting.

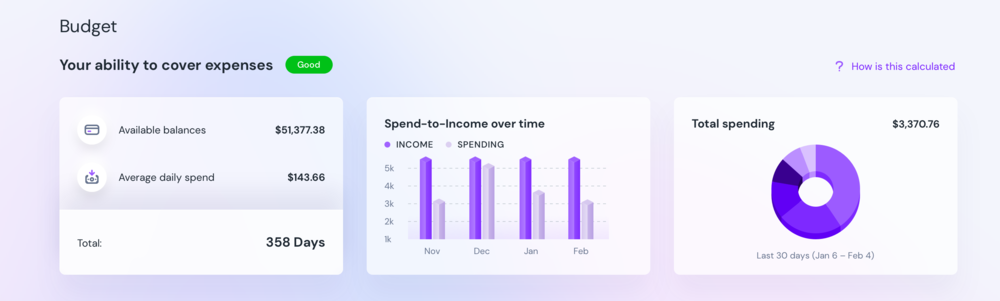

Imagine categorizing your spending with a swipe or two and analyzing your patterns when it’s convenient for you, from wherever you happen to be.

Imagine online bill payment that reminds you of when your payments are due and lets you resolve them with a click or a swipe.

Imagine debt reduction strategies as easy to follow as keeping your fitness tracker happy.

Imagine automatic alerts to your phone or desktop anytime your balance is low, a potential late fee is about to be charged, or an unexpected transaction impacts one of your accounts.

Imagine how easy it is to save money on bills by having your finances and billing at your fingertips or a few clicks away on any connected device. Imagine how much more efficiently you can reduce your debt when the same technology that tries to get you to buy stuff or lose yourself on social media is dedicated to helping you make more strategic financial choices.

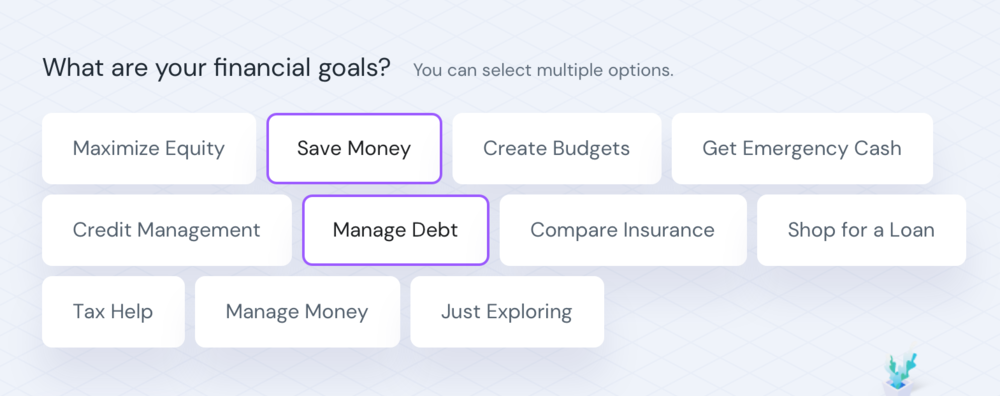

Now imagine that this same expense and debt management app can be interconnected with as many or as few related financial management tools as you choose, all with one easy log-in and a password of your choice. It’s about more than a fancier way to pay bills and debts. It’s more than a banking app or a debt payoff planner that just happens to be online. It’s unified finance.

Any debt payoff strategy worth the name starts with creating an effective household budget. We have plenty of useful, encouraging insight on the best way to get started with a personal or small business budget. We’ve outlined the most important elements and offered essential budgeting tips to help you maintain your efforts during those critical first few months. You simply cannot pay bills and debts more effectively unless you start with the basic. You can’t have a budget to pay off debt unless you first have a budget!

The reason budgets are essential to any debt payoff strategy is that you can’t eliminate debt until you stop adding more of it. You can’t make things better until you stop making them worse! An effective budget means spending the same or less as your reliable income each month, and spending on your chosen priorities. If you’re regularly spending more than you bring in, no debt payoff planner in the world can make it all better.

Budgets are about organizing information, but they’re also about changing spending habits and being more intentional about our choices. Budgets are about clarity and taking the emotions out of major financial decisions – or at least reducing the role those emotions play.

This is an approach made famous by Dave Ramsey. It takes the idea of a “debt avalanche” and turns it back the other direction. Your basic snowball debt payoff looks like this:

List all of your existing debts. Put them in order from smallest to largest. (Don’t worry about interest rates; focus on total balances.)

Pay the minimum possible on everything except the smallest debt on your list. Pay as much as you can on your smallest debt without going into new debt.

When your smallest debt is paid in full, move to the next smallest. Repeat until all debts are paid.

The snowball method focuses on eliminating the number of debts you’re juggling. If that doesn’t sound important, pretend for a moment that you currently owe $10,000. Is it better to own one creditor $10,000 or to owe fifty creditors $200 each? Sometimes it’s the number of debts we’re trying to keep up with which proves overwhelming. The debt snowball method addresses that with great success.

Another debt payoff strategy whose effectiveness “snowballs” over time is the “time saves money” approach. Hopefully you have a specific time each week during which you balance your checkbook and pay your bills. Make a similar commitment to spend a little time each week – 30 minutes or so – eliminating expenses.

That recurring small charge that shows up on your credit card statement from time to time which you keep meaning to track down. Your digital subscription to the site you never actually get around to reading. The rebate that never showed up or the refund you have to fill out a form to receive. Once a week, you dedicate yourself to tackle one or more of these “leaks.”

Renegotiate your cell phone or cable TV plan, for example. Tell them up front you’d like to look at options for cutting your monthly bill. If you have genuine options for switching providers, politely share that, but avoid bluffing (it’s dishonest and they usually know your options before you do). The person at the other end probably didn’t craft company policy, but they certainly have options, even if that involves bumping you to someone who CAN work out a better deal.

It’s not hard, but these calls take time and can be draining unless you’ve set aside time each week specifically for dealing with such things. No one change is likely to make a major difference by itself. Often, we tell ourselves it doesn’t matter. But if you can lower your cable bill by $15/month one week, track down and cancel a few subscription you don’t use the next, and switch family phone plans on week three, the savings are cumulative.

Sometimes when we talk about the quickest way to pay off debt, what we’re really talking about is making debt more manageable. Many of us are going to have some level of debt during most of our adult lives, no matter how responsible we are. There’s nothing shameful or unhealthy about having a mortgage, financing a vehicle, paying back student loans, or even strategic credit card use.

When you’re trying to budget to pay off debt, however, the sheer volume of creditors and due dates and terms can prove as overwhelming as the dollar amounts themselves. That’s why people in situations very much like yours have often chosen to take out some form of debt consolidation loan. These can be based on home equity, secured by collateral, or simply rely on your good name and credit history.

The goal of a single loan to pay off debt is to streamline multiple existing debts into a single monthly debt at a decent interest rate. Instead of five or ten or more payments to keep track of each pay period, you have one. That means less time paying bills, less overall stress, and dramatically reduces the chances of incurring late fees or other penalties for late payment. If you don’t know how to pay off bills fast, maybe that’s the wrong question. Maybe what you should be asking is how to get pay bills and debts more effectively.

This is the 21st century, and while piles of unopened mail and licking envelopes may seem nostalgic, they’re rarely efficient or entirely effective. There’s no reason not to take advantage of the many flexible and creative budgeting, bill-paying, and debt management tools available online or as downloads. Organizing your spending and analyzing your debt should be as easy as checking Twitter or posting to Instagram.

When we pay bills and debts, it’s not just our balances we hope will decrease. Most of us would like for our blood pressure to drop a bit as well. There’s a personal cost to the burden of debt and the headache of paying bills and stretching budgets beyond the financial. It saps your energy and makes it difficult to focus on the people and goals we care about the most.

Difficulty keeping track of bills or discovering you owe more than you can pay right away doesn’t make you a bad person, or even an irresponsible citizen. We live in complicated times and even just getting by is expensive. Feeling overwhelmed isn’t just a mathematical issue; it can chip away at our sense of personal worth, of having things under control, of being able to take care of ourselves and those we love.

Yes, we want to make it easier to pay bills and debts. That’s just part of the equation, however. We want to give you the information, connections, and tools you need to take more effective and more fulfilling control of your personal or small business finances.

We have a foundational belief here at Budgetry, and across the Goalry family, that while budgets and bills aren’t always fun or easy, they don’t need to be as complicated as they sometimes seem. We believe that with the right information, tools, and connections, most of us are perfectly capable of taking more effective control of our personal or small business finances.

That’s why we created (and continue to expand) the Goalry “finance mall” – ten interconnected sites, each designed to simplify your personal or small business finances. Whether it’s real estate, taxes, investments, budgeting, debt management, loans, or simply checking your credit score and credit report, Goalry means access, information, and connections to the services you decide you need.

Shopping cart with bags in it If all you’re looking for is the best app to pay bills and debts or help you utilize your budget more effectively, we’re glad you’re here. We’ll soon be rolling out our own upgraded bills and debt management service. As with everything we do, our goal is to offer you enough power and flexibility to manage your specific circumstances while keeping things simple and intuitive to use.

If that’s enough, and the only reason you’ve come to this part of our Goalry Financial Mall, that’s awesome. Welcome. We’re glad you found your way to us, and we’ll do whatever we can to help while you’re here.

It's worth noting, however, that taking advantage of the tools and information offered here at Budgetry gives you the same access to our sister sites and anything they have to offer as well. If you’re worried about your retirement options during this time of job insecurity, you’re not alone – it’s an important topic over on Wealthry. If you’re considering refinancing your mortgage, we have information and insights you might want to check out over at Loanry before making your final decision. Are you analyzing the pros and cons of starting your own small business and wondering what sorts of options you might be overlooking? Yeah, we can help with that, too.

Maybe you just want to know your credit score or check your credit report for free. No need to even break a sweat for that one.