Manage Spending

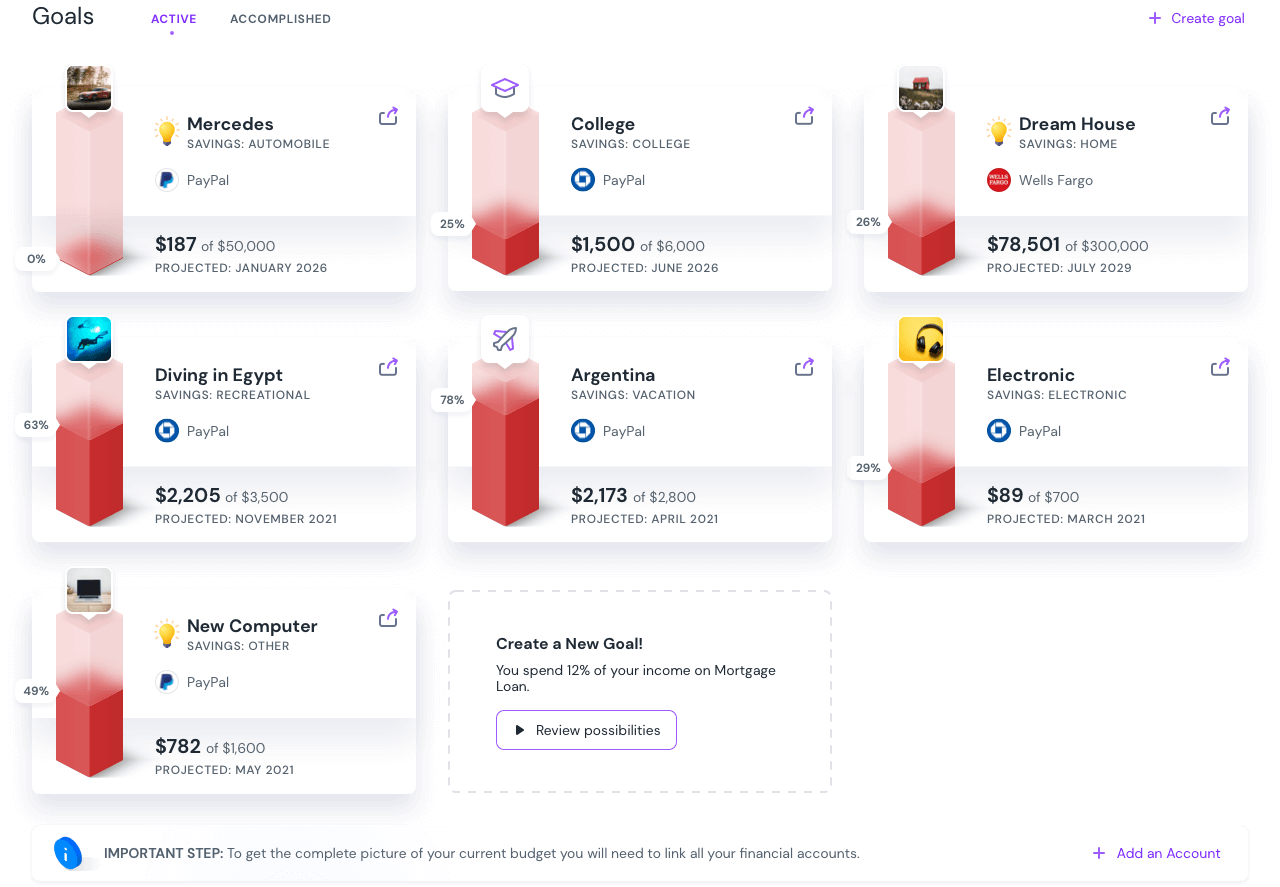

Imagine categorizing and saving that status of every dollar you spend

With only a few swipes or clicks, in real time as you go about your business. You don’t have time to forget where the money went because it’s saved and organized for you as your using it.

One that alerts you as often or as rarely as you prefer whenever your balance is low, scheduled payments are almost due, or there’s unexpected activity in one of your accounts. Imagine being immediately informed whenever your spending strays too far from your stated priorities. You can’t overspend because you always know exactly what you have, in what form, and what’s due next.

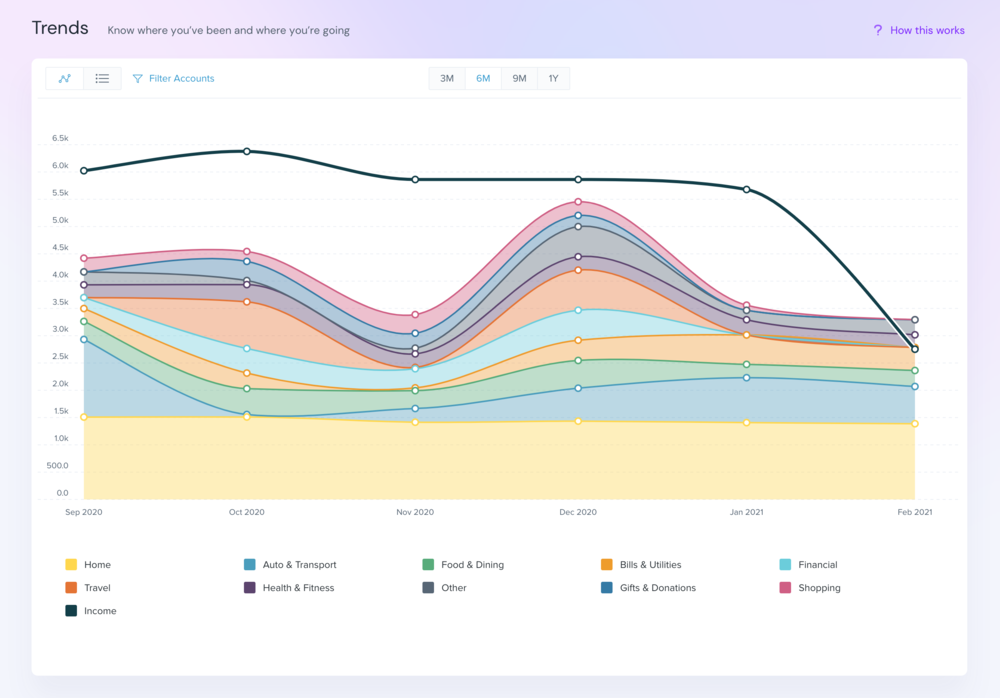

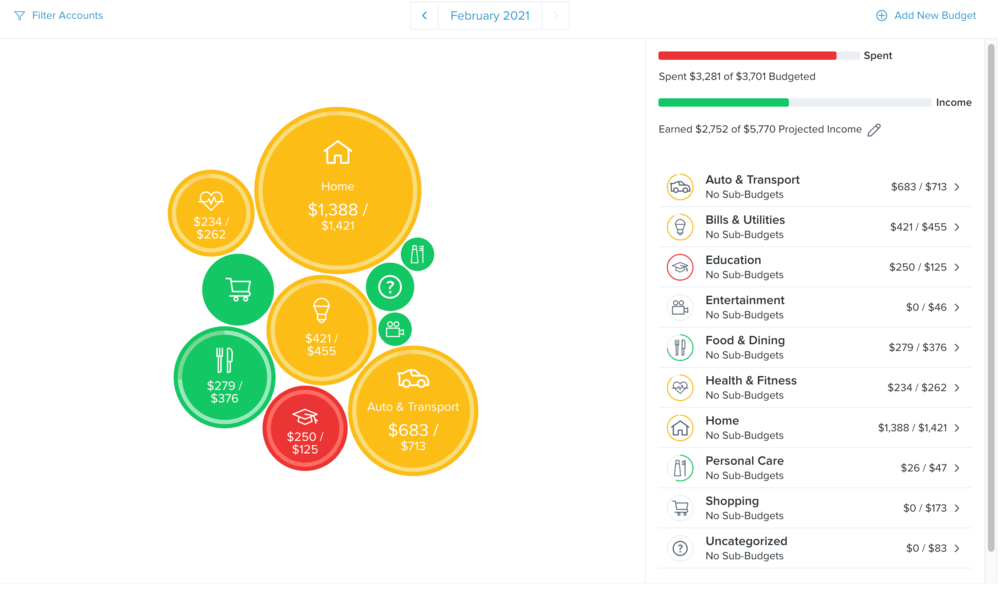

Viewing it by week, month, or year, broken down by category, or time of day, or payee, or amount. Keeping track of money spent, how much, where, and when, is often the most challenging part of any effective budget, but it doesn’t have to be. It’s always up to you what to spend money on, but better information means better choices.

Choosing default categories or customizing some or all of them as you see fit. Imagine a spending tracker that remembers those categories so that it gets smarter and faster the more you use it. Imagine using that information to anticipate future spending and help analyze where you could find the most savings.

The ability to easily track spending by family member, category, or location. Enter the information however you choose or simply record the receipt with your phone camera the same way you deposit checks remotely.

A spending tracker that integrates seamlessly with any other financial tools you choose to utilize – communicating across subjects with a single username and login of your choosing. It’s finance, personalized. Simplified. Unified.

A proper disposable income definition would say something like: “disposable income is the money left over to an individual after deducting their tax obligations.” That’s accurate as far as it goes, but it fails to capture something rather important about the term “dispose.”

“Dispose” and “disposable” cover a great deal of ground in the English language. We dispose of dirty diapers. We dispose of nuclear waste. We dispose of bodies we don’t want the authorities to find. We can also become favorably disposed towards someone based on liking the same music, appreciating the way they handled a difficult situation, or simply finding them easy on the eyes. We feel powerful when we dispose of obstacles with little difficulty. We may decide to accept an invitation from someone, if we’re so disposed.

How do you want to “dispose” of your “disposable income”? Should it leave you feeling like you’ve just changed a diaper, or like you’re shaping your own quality of life and building your own future with each decision? Do you want to manage your average monthly spending, or just do your best to juggle the fallout, wherever it all happens to land? Do you want the tools at your fingertips to make the tough decisions and claim the big wins, or merely stumble along and hope it all somehow magically works out?

When it comes to controlling spending, half the battle is simply keeping track of everything. Most of us know what our priorities are – or at least, what we think they should be. Some of us are even pretty good at making tough decisions when money is tight, deferring what we want in order to focus on what those in our care actually need. We may even think we magically track spending automatically, like some people always know what time it is or which way’s north. It’s not like we don’t know how it’s all supposed to work.

We know we’re supposed to be putting aside some money in savings and paying down our debts and all that. We know we should probably make a budget and set some priorities (although we file that with magical automatic things we hope we’re doing already, like the way we don’t actually track spending but tell ourselves we do). Above all, we’re confident if we could just spend less money we’d have more left over to take care of those other things. There are parts of personal and small business finance which can be rather complicated, but this isn’t one of them. It seems like it should be so… easy.

But we live in complicated times. Even on those days there’s not much on the schedule, it seems like the time flies past and our time and energy are required everywhere at once and then when we do stop to catch our breath… that can’t possibly be the actual time, can it?! Most of our money goes to essentials – paying the mortgage, buying groceries, keeping the lights on and the kids entertained (and don’t try to tell me that’s not “essential” these days).

For most of us, the desire to spend less money or at least spend wisely isn’t overcome by our own lack of willingness or understanding. Far too often, it’s simply a matter of having to make choices about what we focus on and how we spend our time. Besides, we’ll be getting to that whole “work on a proper spending budget” thing soon, right?

You’ve no doubt heard it said that if something’s truly important to you, you’ll find a way to make time for it. You may have said something along those lines to your kids or other family members at some point. And it’s largely true – if something’s truly important, we should find the time. If we don’t, maybe it’s not actually that important to us. That said, there are important things which we can do more efficiently and effectively with modern technology.

Keeping better track of your average monthly spending with the right app or online service isn’t like choosing fast food or frozen dinners over home cooking. It’s an improvement, not a compromise – like when the nurse takes your temperature by running that funny device over your forehead for three seconds instead of putting a mercury thermometer somewhere you’d rather it not be, or when your phone connects to your vehicle to give you driving directions and play music for you instead of trying to make sense of that old road map in the glove box while you reject local station after local station.

21st century technology may not be everything, but come on – it’s pretty cool. Especially when it allows you to enjoy your wealth while helping you refine your spending budget. Consider what that might look like…

There are plenty of things we could do if we had unlimited time and energy – exercise more often, finish those projects around the house, finally get around to that hobby we keep wanting to try. One of the biggies is putting together a meaningful household budget. That starts with a consistent way to track spending.

Too many people have the idea that an effective budget is one that somehow tells you what to do. Whether it’s an app, budgeting software on your laptop, a spreadsheet, or a legal pad, that’s not possible. You spend money the way you choose. It’s your money, after all. You don’t tell me how to spend my money; I won’t tell you how to spend yours – fair enough?

What a real budget does, however, is bring into focus exactly how we choose to spend our money. That’s the hardest part for many people. It’s not the math or the initial time investment required – it’s the undeniable clarity of it all. There’s no hiding from an honest budget. As soon as you begin to track spending habits and compare them to your stated goals, any inconsistencies become alarmingly clear. Too many of us avoid using a meaningful budget, but not because it tells us what should be important to us. We avoid it because it reveals precisely what we already care about and what we’re already doing about it, and those aren’t always the same as what we tell ourselves we care about and we’re doing.

Can this be intimidating at first? Discouraging? Maybe even overwhelming? Absolutely. But only for a moment. After that, it’s empowering. And it doesn’t have to be as difficult as it was even a generation ago. There are things worth doing slowly, and by hand. Craft your own beer, if you like. Wash and wax your own car. Cook that special meal from scratch. The decision to budget and track spending, however, doesn’t require fermentation or marinating anything overnight. With the right tools and the commitment to follow through, technology can reduce the stress of organizing and maintaining a budget and tracking your spending effectively.

You don’t have to be rich to spend wisely, and you don’t have to be impoverished to spend money cautiously and with intent. Taking responsibility for our spending and our personal finances overall is part of “Adulting 101.” Whether you’re 22 or 52, whether you’re living paycheck to paycheck or you just came into your inheritance or won the lottery, we could all do a better job putting on our grown-up pants and choosing to be better stewards of what we’ve earned or been given.

Tracking spending as part of an overall budget doesn’t mean you’re too worried about money; it says you care about the people you take care of and provide for. Organizing your financial world doesn’t mean you care more about money than you do people or spiritual things; it says you have an obligation to behave as wisely as possible with your resources. It’s about taking responsibility and having a plan – one we make and adjust as necessary, but a plan nevertheless.

Most of us in total spend less time making conscious decisions about our spending and how it supports (or doesn’t) our stated priorities and long-term goals than we do deciding what to have for dinner or what to watch on TV that night. On the one hand, maybe that makes us typical Americans. We all know the state the US spending budget is in and how closely Congress and other elected officials stick to their own limits and rules. We can certainly claim that everyone else seems to be making it up as we go along, so why can’t we?

You already know the answer to that. It played in your head just now as you were reading the question. It played in ours, too. Let’s work together to do things a bit better than the government or the “typical” American, shall we? Let’s raise the standard for what it means to enjoy your wealth without adding unnecessary regrets over money spent. We’re not responsible for how the rest of the country behaves; we’re entirely responsible for acting on our own knowledge and ability.

Thankfully, that’s no longer as difficult as it used to be.

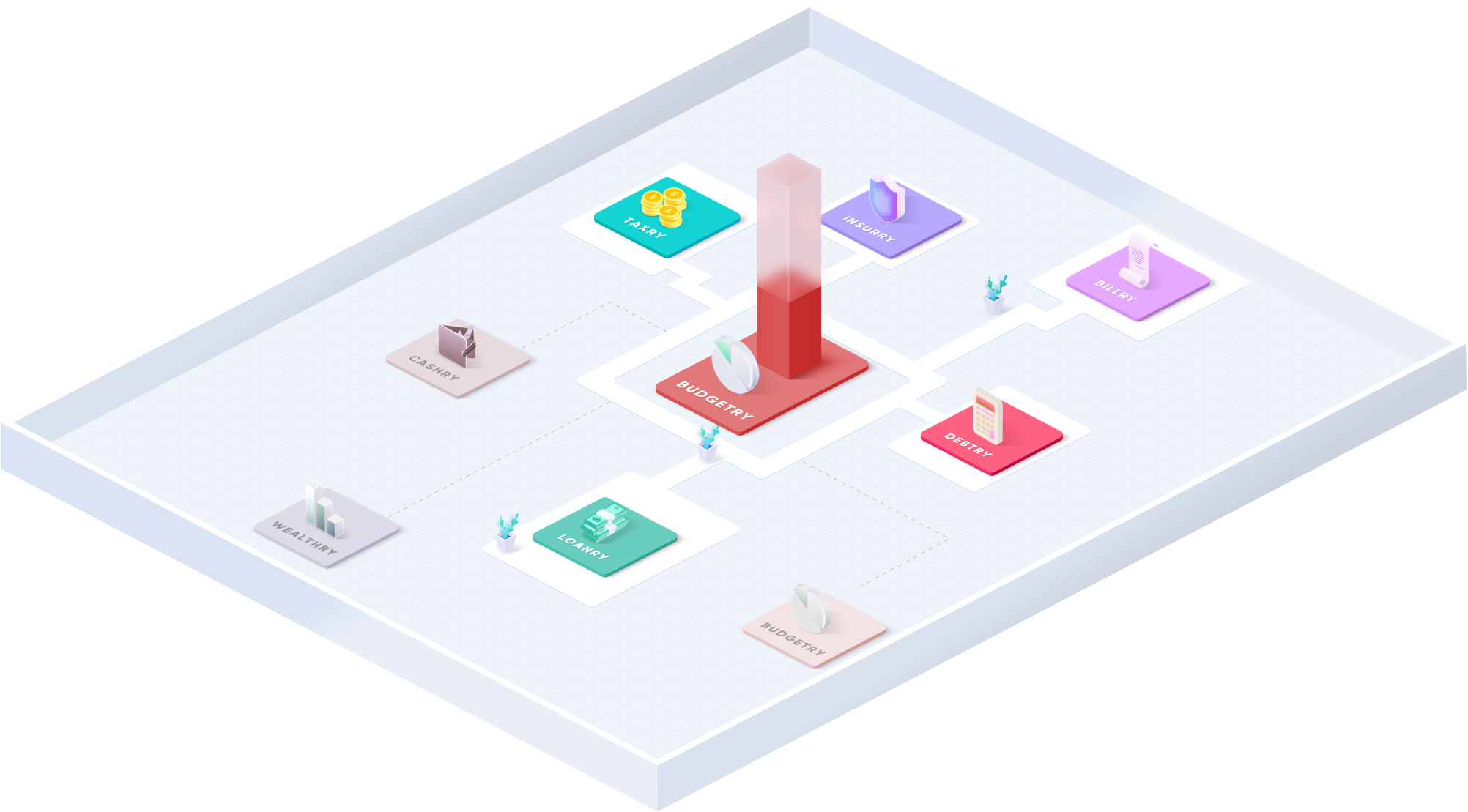

Goalry continues to grow and prosper by remaining faithful to the same vision that brought us into existence in the first place. We believe that with the right information, access, connections, and tools, most of us are perfectly capable of taking more effective control of our personal or small business finances. Whether it’s building a budget, taking out a personal loan, or investing in the future, we believe in the power of unified finance to make personal and small business finances more understandable and more efficient.

If you found us today because you’re looking for a spending tracker app or a better way to organize and analyze what you spend money on each week, month, and year, that’s wonderful. We’re glad you’re here. You picked a great time, as we’re on the verge of rolling out our new and improved personal spending tracker. Our amazing team has taken the most successful elements of the best apps and software used to track spending and organize personal finance over the past decade, along with the elements clients reported they’d most like to see added, and committed themselves to weaving them together without sacrificing ease of use or personal adaptability. Our team is here to listen to all your comments, requests and wishes, and we will do everything we can to make your user experience unique and exceptional.

In the meantime, there’s plenty here for you to access right now, free of any sort of charge or obligation, and more coming soon. We’re glad you found your way to us, and we’d like to do whatever we can to help while you’re here. Utilizing any of the features here at Budgetry gives you the same access to our sister sites and anything they have to offer as well. Information and options for checking your credit report, determining the real value of your real estate, understanding the ins and outs of leasing a vehicle vs. financing that new car or truck – it’s your call how much you use and when. If you’re interested in options for consolidating your existing debt, refinancing your home, vehicle, or student debt, or taking out a small business loan, we can connect you to some surprisingly competitive options for any of these – and more.