Saving and Planning for Retirement

What’s the best time to start getting serious about your retirement savings? To educate yourself on the best retirement plans already out there? To examine your financial budget and figure out when you could realistically have those credit cards paid off and make that final installment on your mortgage? When is it time to design a specific plan for how to best save your money – or at least enough of if that you can live more or less comfortably when you retire?

Many experts will tell you the best time is the day you begin your first job, or graduate from college into your first career. They’re not wrong – the best saving plan is arguably the one that starts the earliest, right? If you could only control one factor to maximize the grand total of whatever retirement money you have available when it’s time, starting early would be a pretty good bet. Unless you win the lottery or somehow you’re your way into the top 1%, you’ll probably be set for early retirement more readily by beginning when you’re 21 than by doubling or even tripling what you set aside for your golden years a few decades later.

Then again, for most of us reading right now, that time of our lives has come and gone. We can sit around kicking ourselves for not having contributed more to that defined benefit plan when we had the chance, or wonder why our sister-in-law or that annoying couple from church are so successful with all their home-based projects and earth friendly money saving ideas when we can barely balance our checkbook some months. Maybe we’ll even pull up some sort of retirement budget calculator online so we can calculate in the most 21st century way possible just how screwed we are.

What if we’ve missed that window? What’s the best time to start getting serious about retirement savings in that case? Maybe once the house is paid for, or at least after we pay down our credit cards or clear out that medical debt – then we’ll start planning for retirement. Maybe after our kids are married and on their own, or we get that promotion at work, or we’re no longer dealing with that one situation, or medical condition, or relationship – then we’d be in a much better position to do some serious retirement planning.

We get it. It’s hard to start when we know we should, and it’s harder to start after it feels like we’ve already missed it. But here’s the thing – no matter where you are in your life, your career, your financial situation, the best time to begin planning for retirement is right now. Today. Not next week when you have more time. Not next month after this or that has passed or such-and-so has changed. Now. Right now.

The 21st century has brought into our daily lives some miraculous uses of technology and some horrifying wastes of time – often more of the latter than the former. Some of the most powerful uses of technology, however, are in many ways the simplest. How many people do you know wearing a fitness tracker of some sort? Using an app on their phone to keep track of calories consumed and burned? Reminding them to get up and move around, or congratulating them on how many steps they’ve walked that day?

The app doesn’t exercise for them. It doesn’t tell them what to eat or how often they’re allowed to have desert. What it does is take the things technology does best – organization, data crunching, and repetitive tasks – and puts it to work for the individual based on that individual’s own choices and needs.

The best retirement planning apps give you easy access to the information you need most, when you need it. The right retirement savings app is powerful and flexible enough to adapt to your specific goals and circumstances, but intuitive enough that it’s easy to use and lets you decide how much or how little you want it to do.

I’m about to share one of the most powerful savings and retirement secrets you’ll ever come across – right here, right now, for free.

One of the primary reasons folks come to us here at Goalry is for money saving tips. They want to know if there are any secrets or systems or methods they can use to save money. And yes, there are ways to save money more effectively – approaches we’re happy to discuss for as long as you’re willing to read or watch. They all start the same place, however. They’re all built in the same absolutely essential foundation. That foundation is the single most powerful saving tip of all time, and here it is:

Planning for retirement works the same way. The best time to begin planning for retirement is now. The best way to begin is to start finding ways to save money right now and begin doing them. Once you’re doing that, start taking advantage of the many available resources to learn more, to keep doing it, and to gradually develop your own strategy for the future. Don’t plan on planning for retirement. Plan by starting. Today.

This is true whether you’re 26 or 62. Until you’ve invented a reliable and affordable time machine, your best best saving plan for retirement no matter what stage of life you’re in is to start saving for retirement. Yes, you should research the best way to save money fast. Yes, you should let us help you with debt reduction, cutting down on utilities and other monthly expenses, and making smarter debt decisions. Don’t wait until you feel ready, however. Start, then improve.

Imagine comparting investment or savings options on different terms, and different rates, over different time periods, as easily as you check social media to see if there are any new pictures of the grandkids or your favorite emu.

Imagine real time updates on interest rates or other factors impacting your existing investments and savings accounts. Imagine exploring your options with a few swipes or easily seeking expert insights with a click or two.

Imaging sitting down with loved ones to enter upcoming weddings, the option of going back to school, the possibility of more children, and easily charting the likely impact of each event on your long-term savings and investments.

Imagine automatic analysis of your existing spending and savings habits to more accurately gage how close you are to reaching your retirement goals and what minor adjustments now might have the most powerful impacts down the roach.

Imagine regular reminders and immediate access to creative ways to save money, tips for your online savings accounts, or plain, simple English explanations of financial terms and strategies.

Imagine a retirement savings app that seamlessly integrates with any other budgeting, spending, or investing apps you choose to utilize. Imagine unified finance together in one place from any connected device – information, tools, and connections.

Imagine being further ahead on planning for retirement tomorrow than you are today. Big decisions often happen in small, regular increments. The choices you make right now can mean major changes – good or bad – in three months, three years, or three decades.

Yes. There’s really no way to argue other sides of this. It’s not so much a “yes/no” question as a “yes/absolutely” question.

If you live long enough (and presumably that’s what most of us are hoping for), you’ll eventually reach a point that you no longer wish to work. Maybe you’ll reach a point that you can’t work. When that happens, you’ll want to have access to enough resources that you can live in your home (or wherever else you choose) and take care of yourself. You’ll want to know you have the best savings account available to you and that you’ve made the best choices you could along the way.

There’s no guarantee our kids will be able to take care of us, and no parent wishes that on their offspring even if they could. We all hope Social Security or other government services will still be around, but that’s rarely enough to live on and these are strange times – who knows what things will look like in a few decades? Hopefully that retirement package from work will help, but for most of us, if we have a retirement plan at all, it’s a supplement at best – not enough to live on comfortably.

There are few guarantees in this broken world. Here’s one, however: if you start planning for retirement today, you’ll be far, far better off than if you don’t.

There are several elements every financial advisor will suggest you prioritize, whether you’re doing retirement planning or just trying to get out of debt and improve your overall financial situation. The first is to develop a household budget, and use it. Budgets aren’t there to tell you how to spend your money. It’s your money; spend it however you think best. Budgets are there to bring clarity and purpose to your income and spending.

You can’t make better choices about spending and saving until you know more precisely where it’s all going now. What those choices are, however, will still be entirely up to you. If you decide you feel strongly about spending $100 a month on fast food and trendy coffee while falling further and further behind on the rent, that’s great – more power to you. If you’re certain you don’t spend that much on fast food and trendy coffee (even though you do), and have no idea why you can’t keep up with the rent, well… you see the problem.

Before you can more meaningfully save your money, you have to know how much of it you have and where it’s going currently. You have to own your choices and make clear, conscious decisions about your spending priorities. Only after working with a legitimate budget for a few months can you make informed decisions about whether or not to change (or eliminate) credit cards, refinance your mortgage, or take out some form of debt consolidation loan. It’s not always easy, mentally or emotionally, but it’s essential if you’re going to get serious about building up some retirement money.

The second element most financial advisors would insist you prioritize is an emergency fund. Ideally, even before you prioritize paying off your current debt, you do whatever it takes to set aside enough home savings that you could pay at least three months of bills – mortgage, vehicles, utilities, groceries, etc. – if your income were disrupted. Six months is better.

You may be wondering how you even begin such a thing, especially if you’re already living paycheck to paycheck and sometimes have trouble keeping up in the first place. If you’ve read this far, you already know the answer – you start. Set aside $100. If you can’t do that, do $50. If you can’t do that, $20.

The third element is paying off debt. This is a huge issue for most Americans, but it’s quite possible and people just like you find ways to be successful with this more often than you’d think. We’ve written about it extensively across the Goalry family of unified finance sites. For now, let’s acknowledge that there are different schools of thought about how much to prioritize finding ways to save money for retirement and how much to instead first focus on paying off debt. Both are important, and both begin the same way.

You start. Now. Today. You can pay off a lot and save a little, or pay off a little and save a lot. Maybe the best you can do is to pay off a little and save a little. You know what that makes you? It makes you ahead of where you were yesterday. Guess what you should do to feel just as successful this time tomorrow?

There’s no single answer to this that applies to everyone. Here are a few general guidelines, however.

Most experts suggest you plan on saving enough through a combination of retirement plans, investments, and personal savings to replace 70% - 80% of your current income upon retiring. What that means is going to vary widely depending on where you live and the lifestyle to which you’re accustomed. There’s also some uncomfortable guesswork about just how long we’re likely to live after retiring. Medical science is able to extend life in some very impressive ways. Unfortunately, that doesn’t automatically come with extended income.

Start be making sure you know what is and isn’t happening with any retirement plan you have through your employer(s). Many of us check some boxes when we’re hired, but our attention at that point is on other things. Do you have the option to contribute additional savings each pay period? What happens if you change jobs? If you don’t know, check with Human Resources or dig out the brochure or business card of whatever financial institution your employer partners with. Ask.

Next, educate yourself on savings and investment options for “normal people.” Contrary to popular belief, you don’t have to be wealthy to invest. Many investment options are relatively low-risk and don’t require constant attention to stock market reports or complicated spreadsheets. Start with the blogs at Wealthry and other members of the Goalry family. Use other reputable online sources if you wish. It may even be worth hiring a local professional after asking around and verifying their reputation and track record.

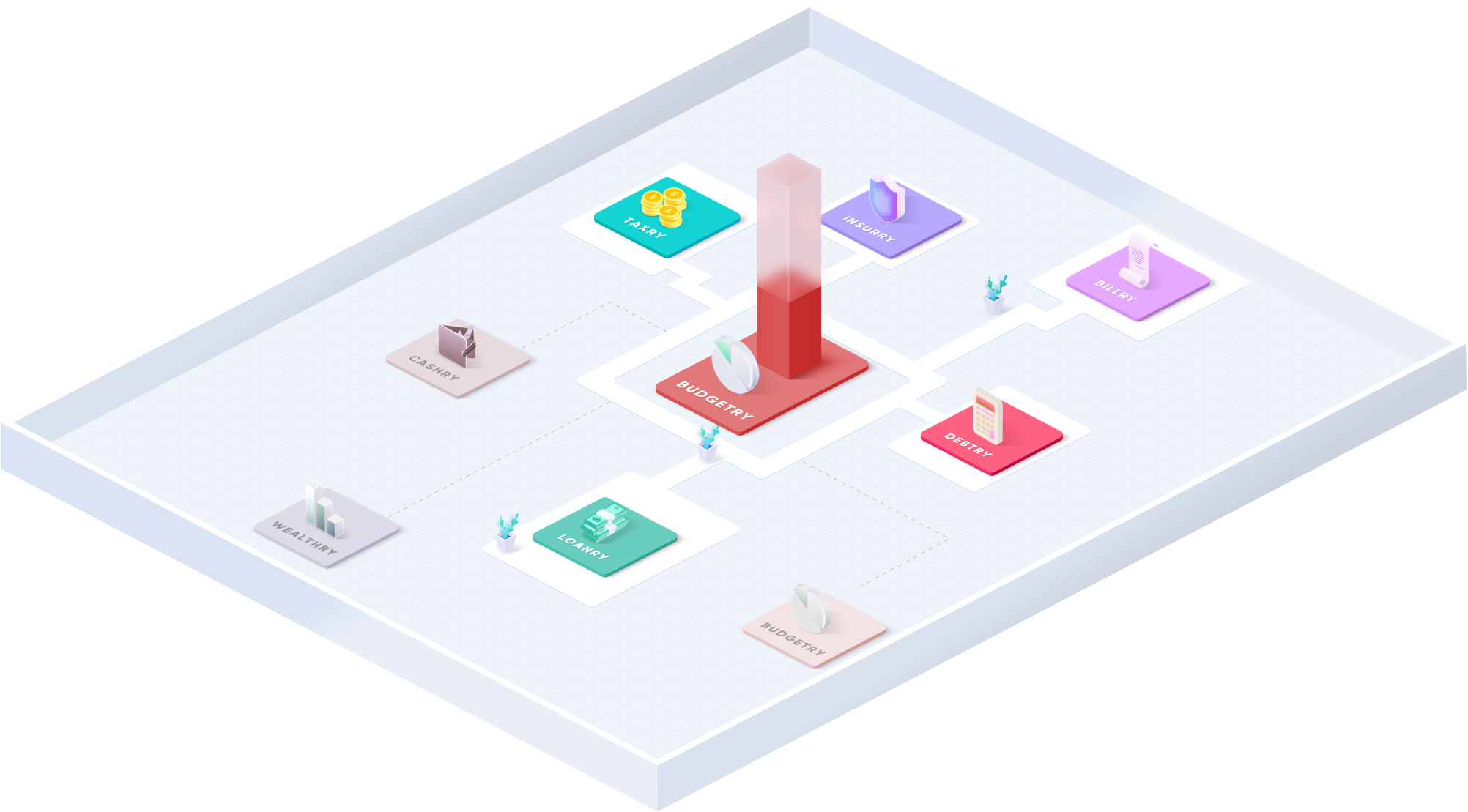

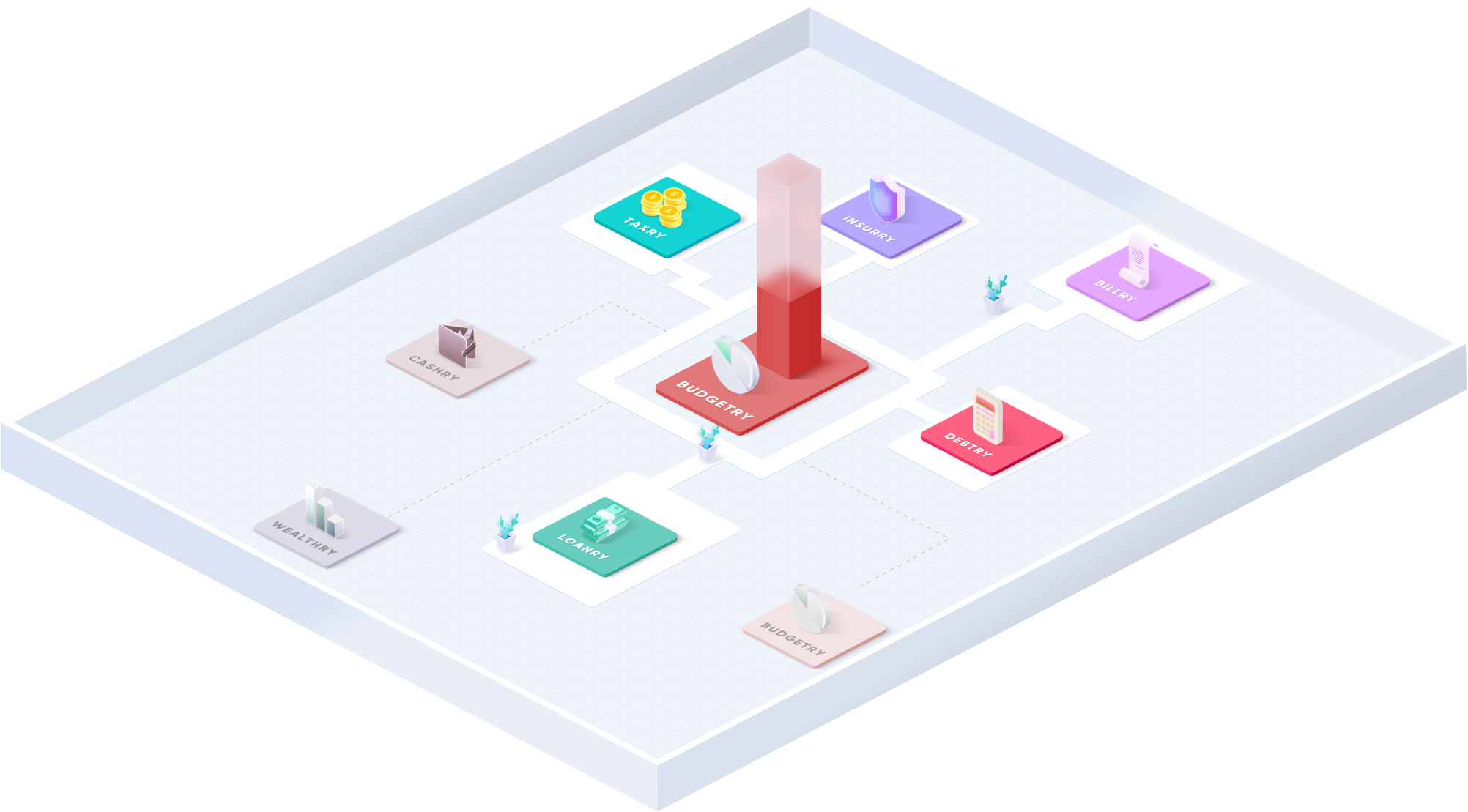

Here at Budgetry, and across the Goalry family, we believe that while planning for retirement isn’t usually easy, it doesn’t have to be as complicated as it often seems. We believe that with the right information, tools, and connections, most of us are perfectly capable of taking more effective control of our personal or small business finances.

That’s why we created (and continue to expand) the Goalry “finance mall” – ten interconnected sites, each designed to simplify your personal or small business finances. Whether it’s real estate, taxes, investments, budgeting, debt management, loans, or simply checking your credit score and credit report, Goalry means access, information, and connections to the services you decide you need. One login, one password, full access.