Creating A Moving Budget That Feels Affordable

Before You Get Moving…

*pause* Hello? OK, Breath. Now that we got that out of the way….it’s time to start building our moving budget. Ready, Set, Let’s Build a Budget to GO.

How To Build A Moving Budget That Fits You

Moving is expensive. You probably realize that already. Very few people would argue otherwise.

What makes moving different than many other major expenses, however, is all the ways it costs more than we think it will, often in the most unexpected way. In other words, even if you have a pretty good idea what the truck will run you, you’ve got your boxes and tape, and you’ve even agreed to buy pizza and beer for your buddies if they’ll help you haul furniture, a move can still end up costing twice what you’ve figured.

That’s why it’s worth sitting down ahead of time and planning out a moving budget, including some cash left over for unexpected developments. And friend, there are ALWAYS unexpected developments! (If it makes you feel any better, that’s just as true if you decided NOT to move and instead simply remodel the place you’re currently in. There would still be unexpected developments and I’d still be bugging you about making a meaningful budget first.)

As it turns out, having a moving budget, just like living on a budget in general, isn’t limiting – it’s empowering. It allows you to make more effective decisions about where and how to direct your resources. It’s not about telling you what to do; a budget simply helps you be aware of what you’re doing.

That is, in fact, exactly why some of us don’t like them.

I used to think so. Now, I find it more stressful to go into anything major without sitting down and sketching out my best idea of what could be involved and what it will cost, not to mention how I’ll be paying for each element. It’s possible to create a useful, efficient budget for just about anything – once you understand the basics and have practiced it a few times.

How Can I Budget When I Don’t Have Any Money?

How can you MOVE if you don’t have any money? You apparently never played Oregon Trail as a child or did those “westward expansion” simulations in your high school history class, or you’d know how difficult it is to move without at least a LITTLE discretionary income.

Plus, there’s the dysentery (or maybe that was only on Oregon Trail).

But friend, it’s when money is tight that you most NEED a moving budget, or ANY budget! Even a very basic, easy budget with a few general categories to get you started would be a step in the right direction.

Until you get into the habit of drafting a basic budget for any major purchase or event, the idea will probably seem like an unnecessary headache to you. I’ve got packing and planning and figuring stuff out to do! I don’t have time to, um… plan and figure stuff out! Besides, budgets are depressing! These are the same sorts of games we play with ourselves to avoid living on a budget to begin with. We’re afraid it will somehow cramp our style or crush our fun – as if denial and constant confusion and frustration are always such good times.

If anything, it’s people with so much money it doesn’t matter HOW they spend it than can probably manage without a budget. But let’s be honest – we don’t really LIKE any of those folks, do we? We certainly don’t want to BE like them.

Well, except for the having lots of money part. That might be OK.

Step One in Your Moving Budget: Keep on Truckin’

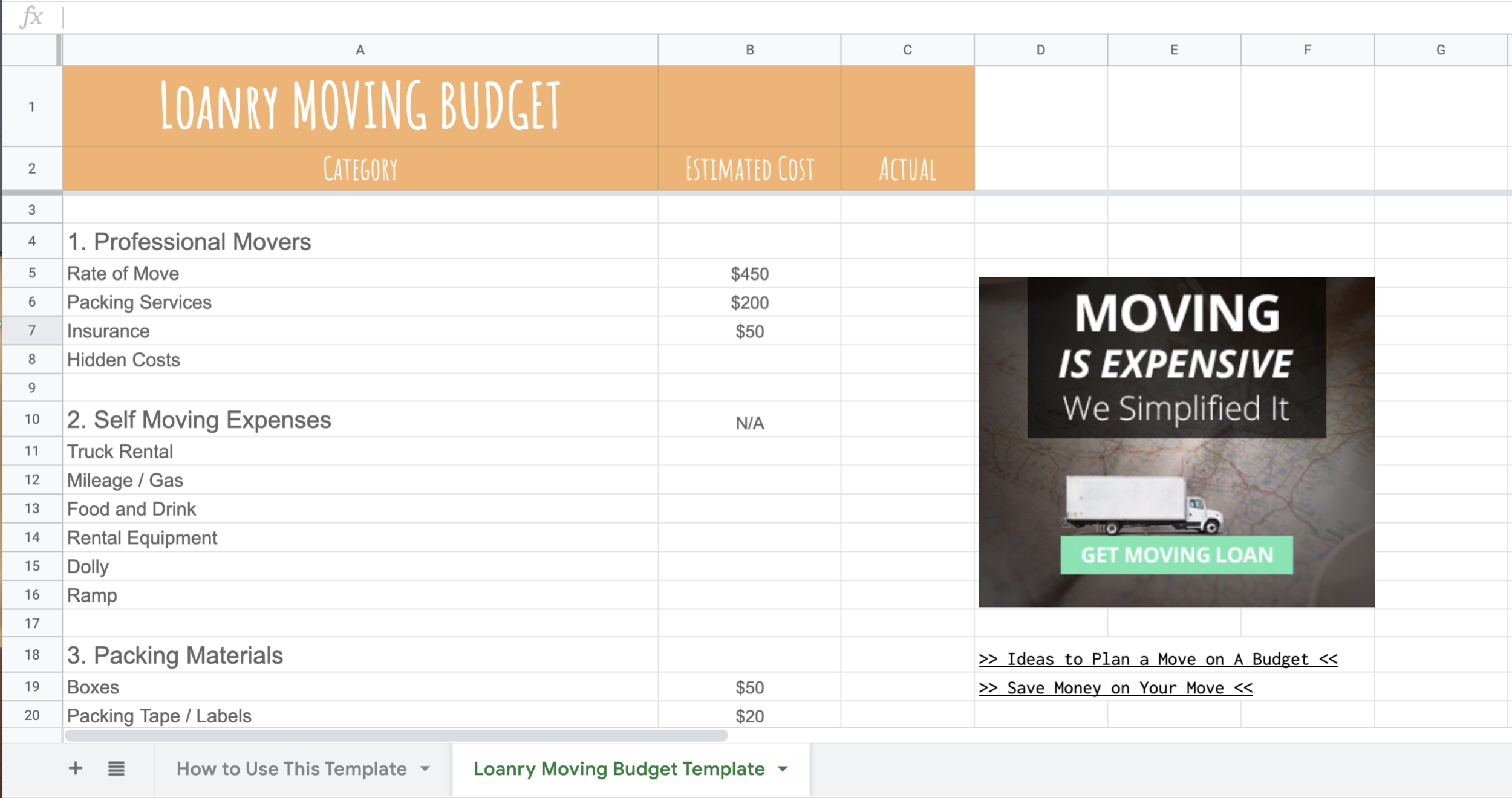

The details will vary with your circumstances and resources, but here are a few things which will almost always show up in a thorough moving budget in one form or another…

Moving Truck – Unless you have a large truck of your own, or about a dozen friends, all of whom own heavy duty pickups, you’re going to need a moving van or truck of some sort. When budgeting for truck rental, make sure you don’t take the advertised rate at face value. Ask about mandatory insurance, local taxes or fees, and whether or not they charge extra for things like blankets, rope, etc. You’ll also want to allow for gas, especially if you’re moving a long distance.

If people are moving less, that means companies who make their living off of people’s moves may need to work a little harder to secure your business. It’s still a fairly insulated industry – in many areas you may only have one choice for moving trucks and supplies. Still, it doesn’t hurt to shop around and see what you can work out.

Step Two in Your Moving Budget: Bubble Wrap, Boxes, and Tape – Oh My!

Obviously you should start gathering and saving boxes and packing supplies from the day you decide you’ll be moving – maybe sooner. Check with your workplace, with local industries, and of course there’s always the classic “liquor store” option. If you’re moving an entire household, however, you may end up buying boxes as well. Check out your local home improvement stores as well as moving supply companies.

There’s a wider-than-expected range of price points for the same basic sorts of boxes from different places, so take a little time on this one. Ask about the options of returning unused boxes so you don’t have to be afraid to buy more than the bare minimum you might need. You should still figure the maximum cost in your moving budget; then, if you get money back – bonus!

Think about what’s likely to go IN each box when determining size. Books, dishes, and CDs, for example, are heavy. If you fill up even a medium-sized box with these items, it’s going to make it difficult for your movers and increases the chance of something getting damaged or tearing open.

Finally, assume you’ll need about 25% more boxes, packing, and tape than your highest estimate. Unless everything you own is square and roughly the same size, it will take more room to pack everything safely than you think it will.

Step Three in Your Moving Budget: Extra Manpower

It may not be physically or logistically practical for you to pack, load, and move everything yourself. There’s no shame in hiring professional packers and movers to do it for you.

More than most services, however, this is one deserving of some research and comparison. Ask friends, neighbors, even acquaintances who they’ve used and whether they’d hire them again. Many times, local family-run options will prove far more reliable and effective than anything you book through a name-brand company – but again, it all depends on your options.

Make sure you ask about insurance and what sort of guarantees, if any, they offer on the condition of your stuff and the time frame for moving it. Once you’ve committed, this DEFINITELY has to go in your moving budget.

Step Four in Your Moving Budget: Hello, Dolly!

If you haven’t moved recently, or didn’t have a family and so much stuff before, don’t underestimate the value of things like an extending ramp on the back of your moving truck, or a few heavy-duty dollies, blankets, and some rope.

The ability to maneuver heavy objects safely and pack them firmly against one another without damaging them is game-changing for a successful move. A snug fit means less bouncing around and damaging your stuff, and if that means some extra blankets and taking the time to tie or bungee-strap stuff down six-ways-to-Sunday, it’s probably worth it.

Build Your Budget with the budgetry shop.

Step Five in Your Moving Budget: On the Road Again

If you’re moving more than an hour away, gas is going to be an expense worth including in your moving budget. Moving’s hard work, and at some point people may want drinks or snacks. Even if they don’t ask, you should offer.

Since we’re talking food, if you’re packing as much ahead of time as you should be, you’re going to have several days in which it’s difficult to cook a meal at home. Once you’ve arrived, plan on a few more days before you can comfortably prepare more than a sandwich and chips in your new place. Add any meals taken on the road, and this is another expense for your moving budget.

As a side note, it’s certainly not my job to tell you what to eat, but it’s easy to fall into the trap of eating fast food 2 or 3 times a day during a move. If that’s now how you normally eat, you’re going to quickly feel gross as a result, and that’s not how you keep focused and efficient for something as draining as a move. If that IS how you normally eat, then gross – we should talk about this, but not until we get through your move.

Step Six in Your Moving Budget: We’re Here!

We started with one of your largest expenses, and we’ll conclude with another several.

If you’re renting an apartment, you’ll probably be asked to make a security deposit along with paying your first month’s rent. Hopefully you’ve already factored this in as a major expense.

If you’re moving from a big place to somewhere slightly smaller, or several of you are moving in together, you may need a separate storage unit, at least temporarily. These are amazing services, but they’re not cheap. This should definitely go on your moving budget, if applicable.

Here’s one you won’t like to hear. It’s rare for anyone to make a major move without something breaking. Hopefully you’ll beat the odds, but be aware you may have to replace an appliance, a piece of furniture, or even a TV or other electronics. Or, all of your appliances arrive just fine, but they don’t all fit quite where you thought they were. Even if you measured and estimated and did some math, sometimes stuff doesn’t do in reality what it showed it would do on paper.

It’s difficult to plan on this too precisely in your moving budget, but leave some room for “unexpected expenses,” then hope you don’t need to use it.

How Do I Pay For Moving Expenses?

I assume you’ve been saving for years for just this moment. I don’t mean your regular savings, of course – we want to keep that going. It’s usually a bad idea to empty your savings when there are other options. Plus there’s your emergency fund – that’s like savings, but with the understanding that from time to time stuff happens and you need unexpected resources.

But apart from those two things, how much do you have saved just for moving?

Yeah, me either.

In all seriousness, if you know ahead of time you’re going to be moving, every little bit you can set aside helps. Every meal you can pay for out of pocket without going into debt, every tank of gas you can fill without pulling out a credit card, is a win. Remember, you’re not just spending the money – you’re spending the interest on the money, and interest on that interest, and fees on the payments you miss as a result, and lost opportunities because you can’t afford to do or buy other things because of debt, and… and…

Yes, I’m being a touch dramatic about it, but I want to drive home a point. Saving a lot is better than saving a little, but saving a little is better than not saving at all because it doesn’t seem like it makes enough difference.

Can Credit Cards Cover My Moving Budget?

Well, sure… maybe. The question really isn’t “CAN they?” so much as “SHOULD they?”

If you have a high limit and a low balance on your card or cards, and an amazingly low interest rate, it might be possible to pay for part or all of your move by simply charging things as you go. It would certainly be convenient, and some of you would really like the part where you could fudge on creating a decent moving budget in the first place because hey, you’re just going to charge everything, right?

Most credit cards, however, have higher interest rates than other forms of borrowing. They’re really not ideal for major expenses you’ve had time to plan for ahead of time. If you wanted to use your credit cards for gas or food during the move, that might make sense – especially if you have some sort of cash back or rewards feature that favors those sorts of purchases. But for the main expenses of the move?

It’s an option, but I don’t love it for most situations.

What About A Personal Loan to Pay for Moving Expenses?

If you’re moving, there are some advantages to taking out a personal loan specifically to pay for moving expenses. You don’t want to cut it too close (remember the part about there ALWAYS being unexpected costs in a major move), but neither should you borrow excessively just to borrow. That’s where a thoughtful moving budget once again comes in so handy, and so important.

What are these advantages?

Money up front so you don’t have to worry at each stage how you’re going to pay for the next.

In most cases, better terms and lower interest than a credit card.

Easier to negotiate if you’ve already secured funds to pay for things.

Preserve your savings and emergency fund for their intended purposes.

Repayment is scheduled for a set number of months at a fixed interest rate, so it’s easy to budget for.

Build (or rebuild) your credit score and strengthen your credit history by making your payments regularly.

Did I mention how much less stressful it is if you’ve already planned out a moving budget and have the money part taken care of in advance?

Conclusion

Whether you’re headed across town or across the country, moving is an amazing opportunity to reboot and tackle new challenges along with a new life. At the same time, it can be a stressful and expensive experience. Take a few deep breaths, and know that you got this.

In the meantime, shouldn’t you be calling around for boxes?